program areas Digital Consumer

Program Areas

-

Press Release

BREAKING: Advocates Decry Meta’s Attempt to Shut Down the FTC

In response to an order that would prohibit Meta from monetizing minors’ data, the social media company has filed a suit claiming the agency’s structure is unconstitutional.

Contact: David Monahan, Fairplay, david@fairplayforkids.orgContact: Jeff Chester, CDD, jeff@democraticmedia.org BREAKING: Advocates Decry Meta’s Attempt to Shut Down the FTCIn response to an order that would prohibit Meta from monetizing minors’ data, the social media company has filed a suit claiming the agency’s structure is unconstitutional. WASHINGTON, DC – THURSDAY, NOVEMBER 30, 2023 – Advocates for children and privacy condemned a lawsuit filed last evening by Meta against the Federal Trade Commission that seeks to shut the agency down by asserting the Commission’s structure is unconstitutional. Meta’s suit comes in response to a proposed FTC order prohibiting Meta from monetizing children’s data for violating the Children’s Online Privacy Protection Act (COPPA) while already operating under a Consent Decree for multiple serious privacy violations. Earlier this week, Judge Timothy Kelly of the U.S. District Court for the District of Columbia denied a motion filed by Meta that claimed the FTC had no authority to modify its previous settlement. Now Meta is escalating its attacks on the Commission’s authority.Meta has posed a threat to the privacy and welfare of young people in the U.S. for many years, as it targeted them to further its data-driven commercial surveillance advertising system. Scandal after scandal has exposed the company’s blatant disregard for children and youth, with nearly daily headlines about its irresponsible actions coming from former employees turned whistleblowers and major multi-state and bi-partisan investigations of states attorneys-general. Despite multiple attempts by regulators to contain Meta’s ongoing undermining of its user privacy, including through multiple FTC consent decrees, it is evident that a substantive remedy is required to safeguard US youth. Fairplay, the Center for Digital Democracy, and the Electronic Privacy Information Center (EPIC) have issued these comments on today's announcement of a Meta lawsuit against the Federal Trade Commission: Josh Golin, Executive Director, Fairplay: “While many have noted social media’s role in fueling the mental health crisis, the Federal Trade Commission has taken actual meaningful action to protect young people online by its order prohibiting serial privacy offender Meta from monetizing minor’s data. So it’s not surprising that Meta is launching this brazen attack on the Commission, especially given the company may have $200 billion in COPPA liability according to recently unsealed documents. Anyone who cares about the wellbeing of children– and the safety of American consumers – should rally to the defense of the Commission and be deeply concerned about the lengths Meta will go to preserve its ability to profit at the expense of young people.” Katharina Kopp, Director of Policy, Center for Digital Democracy: “For decades Meta has put the maximization of profits from so-called behavioral advertising above the best interests of children and teens. Meta’s failure to comply repeatedly with its 2012 and 2020 settlements with the FTC, including its non-compliance with the federal children’s privacy law (COPPA), and the unique developmental vulnerability of minors, justifies the FTC to propose the modifications of Meta’s consent decree and to require it to stop profiting from the data it gathers on children and teens. It should not surprise anybody then that Meta is now going after the FTC with its lawsuit. But this attack on the FTC is essentially an attack on common sense regulation to curtail out-of-control commercial power and an attack on our children, teenagers, and every one of us.” John Davisson, Director of Litigation, Electronic Privacy Information Center (EPIC): “It seems there's no legal theory, however far-fetched, that Meta won't deploy to avoid a full accounting of its harmful data practices. The reason is clear. A hearing before the FTC will confirm that Meta continues to mishandle personal data and put the privacy and safety of minors at risk, despite multiple orders not to do so. The changes FTC is proposing to Meta's exploitative business model can't come soon enough. We hope the court will reject Meta's latest attempt to run out the clock, as another federal court did just this week.” ### -

Blog

Is So-called Contextual Advertising the Cure to Surveillance-based “Behavioral” Advertising?

Contextual advertising might soon rival or even surpass behavioral advertising’s harms unless policy makers intervene

Contextual advertising is said to be privacy-safe because it eliminates the need for cookies, third-party trackers, and the processing of other personal data. Marketers and policy makers are placing much stock in the future of contextual advertising, viewing it as the solution to the privacy-invasive targeted advertising that heavily relies on personal data.However, the current state of contextual advertising does not look anything like our plain understanding of it in contrast to today's dominant mode of behavioral advertising: placing ads next to preferred content, based on keyword inclusion or exclusion. Instead, industry practices are moving towards incorporating advanced AI analysis of content and its classification, user-level data, and insights into content preferences of online visitors, all while still referring to “contextual advertising.” It is crucial for policymakers to carefully examine this rapidly evolving space and establish a clear definition of what “contextual advertising” should entail. This will prevent the emergence of toxic practices and outcomes, similar to what we have witnessed with surveillance-based behavioral marketing, from becoming the new normal.Let’s recall the reasons for the strong opposition to surveillance-based marketing practices so we can avoid those harms regarding contextual advertising. Simply put, the two main reasons are privacy harms and harms from manipulation. Behavioral advertising is deeply invasive when it comes to privacy, as it involves tracking users online and creating individual profiles based on their behavior over time and across different platforms and across channels. These practices go beyond individual privacy violations and also harm groups of people, perpetuating or even exacerbating historical discrimination and social inequities.The second main reason why many oppose surveillance-based marketing practices is the manipulative nature of commercial messaging that aims to exploit users’ vulnerabilities. This becomes particularly concerning when vulnerable populations, like children, are targeted, as they may not have the ability to resist sophisticated influences on their decision-making. More generally, the behavioral advertising business heavily incentivizes companies to optimize their practices for monetizing attention and selling audiences to advertisers, leading to many associated harms.New and evolving practices in contextual advertising should raise questions for policy makers. They should consider whether the harms we sought to avoid with behavioral marketing may resurface in these new advertising practices as well.Today’s contextual advertising methods are taking advantage of the latest analytical technologies to interpret online content so that contextual ads will likely soon be able to manipulate us just as behavioral ads can. Artificial intelligence (AI), machine learning, natural language processing models for tone and sentiment analysis, computer vision, audio analysis, and more are being used to consider a multitude of factors and in this way “dramatically improve the effectiveness of contextual targeting.” Gumgum’s Verity, for example, “scans text, image, audio and video to derive human-like understandings.” Attention measures – the new performance metric that advertisers crave – indicate that contextual ads are more effective than non-contextual ads. Moments.AI, a “real-time contextual targeting solution” by the Verve Group, for example, allows brands to move away from clicks and to “optimize towards consumer attention instead,” for “privacy-first” advertising solutions.Rather than analyzing one single URL or one article at a time, marketers can analyze a vast range of URLs and can “understand content clusters and topics that audiences are engaging with at that moment” and so use contextual targeting at scale. The effectiveness and sophistication of contextual advertising allows marketers to use it not just for enhancing brand awareness, but also for targeting prospects. In fact, the field of “neuroprogammatic” advertising “goes beyond topical content matching to target the subconscious feelings that lead consumers to make purchasing decisions,” according to one industry observer. Marketers can take advantage of how consumers “are feeling and thinking, and what actions they may or may not be in the mood to take, and therefore how likely are to respond to an ad. Neuroprogrammatic targeting uses AI to cater to precisely what makes us human.”These sophisticated contextual targeting practices may have negative effects similar to those of behavioral advertising, however. For instance, contextual ads on weight loss programs can be placed alongside content related to dieting and eating disorders due to its semantic, emotional, and visual content. This may have disastrous consequences similar to targeted behavioral ads aimed at teenagers with eating disorders. Therefore, it is important to question how different these practices are from individual user tracking and ad targeting. If content can be analyzed and profiled along very finely tuned classification schemes, advertisers don’t need to track users across the web. They simply need to track the content that will deliver the relevant audience and engage individuals based on their interests and feelings.Apart from the manipulative nature of contextual advertising, the use of personal data and associated privacy violations are also concerning. Many contextual ad tech companies claim to engage in contextual targeting “without any user data.” But, in fact, so-called contextual ad tech companies often rely on session data such as browser and page-level data, device and app-level data, IP address, and “whatever other info they can get their hands on to model the potential user,” framing it as “contextual 2.0.” Until recently, this practice might have been more accurately referred to as device fingerprinting. The claim is that session data is not about tracking, but only about the active session and usage at one point in time. No doubt, however, the line between contextual and behavioral advertising becomes blurry when such data is involved.Location-based targeting is another aspect of contextual advertising that raises privacy concerns. Should location-based targeting be considered contextual? Uber’s “Journey Ads” lets advertisers target users based on their destination. A trip to a restaurant might trigger alcohol ads; a trip to the movie theater might result in ads for sugary beverages. According to AdExchanger, Uber claims that it is not “doing any individual user-based targeting” and suggests that it is a form of contextual advertising.Peer 39 also includes location data in its ad-targeting capabilities and still refers to these practices as contextual advertising. The use of location data can reveal some of the most sensitive information about a person, including where she works, sleeps, socializes, worships, and seeks medical treatment. When combined with session data, the information obtained from sentiment, image, video, and location analysis can be used to create sophisticated inferences about individuals, and ads placed in this context can easily clash with consumer expectations of privacy.Furthermore, placing contextual ads next to user-generated content or within chat groups changes the parameters of contextual targeting. Instead of targeting the content itself, the ad becomes easily associated with an individual user. Reddit’s “contextual keyword targeting” allows advertisers to target by community and interests, discussing LGBTQ+ sensitive topics, for example. This is similar to the personalized nature of targeted behavioral advertising, and can thus raise privacy concerns.Cohort targeting, also referred to as “affinity targeting” or “content affinity targeting,” further blurs the line between behavioral and contextual advertising by combining content analytics with audience insights. “This bridges the gap between Custom Cohorts and your contextual signals, by taking learning from consented users to targeted content where a given Customer Cohort shows more engagement than the site average,” claims Permutive.Oracle uses various cohorts with demographic characteristics, including age, gender, and income, for example, as well as “lifestyle” and “retail” interests, to understand what content individuals are more likely to consume. While reputedly “designed for privacy from the ground up,” this approach allows Oracle to analyze what an audience cohort views and to “build a profile of the content types they’re most likely to engage with,” allowing advertisers to find their “target customers wherever they are online.” Playground XYZ enhances contextual data with eye-tracking data from opt-in panels, which measures attention and helps to optimize which content is most “eye-catching,” “without the need for cookies or other identifiers.”Although these practices may seem privacy neutral (relying on small samples of online users or “consented users”), they still allow advertisers to target and manipulate their desired audience. Message targeting based on content preferences of fine-tuned demographic characteristics (household income less than $20K or over $500K, for example) can lead to discriminatory practices and disparate impact that can deepen social inequities, just like the personalized targeting of online users.Hyper-contextual content analysis with a focus on measuring sentiment and attention, the use of session information, placing ads next to user-generated content as well as within interest group chats, and employing audience panels to profile content are emerging practices in contextual advertising that require critical examination. The touted privacy-first promise of contextual advertising is deceptive. It seems that contextual advertising is more manipulative, invasive of privacy, and likely to contribute to discrimination and perpetuate inequities among consumers than we all initially thought.What’s more, the convergence of highly sensitive content analytics with content profiling based on demographic characteristics (and potentially more), could result in even more potent digital marketing practices than those currently being deployed. By merging contextual data with behavioral data, marketers might gain a more comprehensive understanding of their target audience and develop more effective messaging. Additionally, we can only speculate about how modifications to the incentive structure for content delivery of audiences to advertisers might impact content quality.In the absence of policy intervention, these developments may lead to a surveillance system that is even more formidable than the one we currently have. Contextual advertising will not serve as a solution to surveillance-based “behavioral” marketing and its manipulative and privacy invasive nature, let alone the numerous other negative consequences associated with it, including the addictive nature of social media, the promotion of disinformation, and threats to public health.It is vital to formulate a comprehensive and up-to-date definition of contextual advertising that takes into consideration the adverse effects of surveillance advertising and strives to mitigate them. Industry self-regulation cannot be relied on, and legislative proposals do not adequately address the complexities of contextual advertising. The FTC’s 2009 definition of contextual advertising is also outdated in light of the advancements and practices described here. Regulatory bodies like the FTC must assess contemporary practices and provide guidelines to safeguard consumer privacy and ensure fair marketing practices. The FTC’s Children’s Online Privacy Protection Act rule update and its Commercial Surveillance and Data Security Rule provide opportunity to get it right.Failure to intervene may ultimately result in the emergence of a surveillance system disguised as consumer-friendly marketing. This article was originally published by Tech Policy Press. -

September 18, 2023 Comment on the 2023 Merger GuidelinesCenter for Digital DemocracyFTC-2023-0043 The Center for Digital Democracy (CDD) urges the U.S. Department of Justice (DoJ) and the Federal Trade Commission (FTC) to adopt the proposed merger guidelines. The guidelines are absolutely necessary to ensure the U.S. operates a 21st century antitrust regime and doesn’t keep repeating the mistakes of the last several decades. Failures to understand and address contemporary practices, especially related to data assets, has brought us further consolidation in key markets, including in the digital media. Over rhe decades, CDD has been at the forefront of NGOs sounding the alarm on the consolidation of the digital marketing and advertising industry, including our opposition to such transactions as the Google/Doubleclick merger, Facebook/Instagram, Google/YouTube, Google/AdMob, Oracle/BlueKai and Datalogix, among others. Regulatory approval for these deals has accelerated the consolidation of the online media marketplace, where a tiny handful of companies—Alphabet (Google), Meta and Amazon—dominate the marketplace in terms of advertising revenues and online marketing applications. It has also helped deliver today’s vast commercial surveillance marketplace, with its unrelenting collection and use of information from consumers, small businesses and other potential competitors. The failure to address effectively the role that data assets and processing capabilities play in merger transactions has had unfortunate systemic consequences for the U.S. public. Privacy has been largely lost as a result, since by permitting these data-related deals both agencies signaled that policymakers approved unfettered data-driven commercial surveillance operations. It has also led to the widespread adoption by the largest commercial entities and brands, across all market verticals, to adopt the “Big Data” and personalized digital marketing applications developed by Google, Meta and Amazon—furthering the commercial surveillance stranglehold and helping fuel platform dominance. It has also had a profound and unfortunate impact on the structure of contemporary media, which have embraced the data-driven commercial surveillance paradigm with all its manipulative and discriminatory effects. In this regard, the failure to ensure meaningful antitrust policies has had consequences for the health of our democracy as well. The proposed guidelines should aid regulators better address specific transactions, their implications for specific markets, and the wider “network effects” that such digitally connected mergers trigger. An overall guideline for antitrust authorities should be an examination of the data assets assembled by each entity. Over the last half-decade or so, nearly every major company—regardless of “vertical” market served—has become a “big data” company, using both internal and external assets to leverage a range of data and decision intelligence designed to gather, process and make “actionable” data insights. Such affordances are regularly used for product development, supply, and marketing, among other uses. Artificial intelligence and machine learning applications are also “baked in” to these processes, extending the affordances across multiple operations. Antitrust regulators should inventory the data and digital assets of each proposed transaction entity, including data partnerships that extend capabilities; analyze them in terms of specific market capabilities and industry-wide standards; and review how a given combination might further anti-competitive effects (especially through leveraging data assets via cloud computing and other techniques). As markets further converge in the digital era, where, for example, data-driven marketing operations affect multiple sectors, we suggest that regulators will need to be both creative and flexible in addressing potential harms arising from cross-sectoral impacts. This point relates to Guideline 10 and “multi-sided” platforms. Regarding Guideline 3, we urge the agencies to review how both Alphabet/Google and Meta especially, as a result of prior merger approvals, have been able to determine how the broader online marketplace operates—creating a form of “coordination” problem. The advertising and data techniques developed by the two companies have had an inordinate influence over the development of online practices generally, in essence “dictating” formats, affordances, and market structures. By allowing Alphabet and Meta to grow unchecked, antitrust regulators have allowed the dog to wag the “long tail” of the digital marketplace. We also want to raise the issue of partnerships, since they are a very significant feature of the online market today. In addition to consolidation through acquisitions, companies have assembled a range of data and marketing partners who provide significant resources to these entities. This leveraging of the market through affiliates undermines competition (as well as compounding related issues involving privacy and consumer protection). The steady stream of acquisitions in rapidly evolving markets, such as “over-the-top” streaming video, that further entrenches dominant players and also creates new hurdles for potential competitors, raises the issue addressed in Guideline 8. Repeatedly, especially in digitally connected markets (such as media), there are daily acquisitions that clearly further consolidation. Today they go unchecked, something we hope will be reversed under the proposed paradigm here. Each proposed guideline is essential, in our view, to ensure that relevant information gathering and analysis are conducted for each proposed transaction. We are at a critical period of transition for markets, as data, digital media and technological progress (AI especially) continue to challenge traditional perspectives on dominance and competition. Broader network effects, regarding privacy, consumer protection and impact on democratic institutions should also be addressed by regulators moving forward. The proposed DoJ and FTC merger guidelines will provide critical guidance for the antitrust work to come.

-

Blog

Profits, Privacy and the Hollywood Strike

Addressing commercial surveillance in streaming video is key to any deal for workers and viewers says Jeff Chester, the executive director of the Center for Digital Democracy.

Leading studios, networks and production companies in Hollywood—such as Disney, Paramount, Comcast/NBCU, Warner Bros. Discovery and Amazon—know where their dollars will come from in the future. As streaming video becomes the dominant form of TV in the U.S., the biggest players in the entertainment industry are harvesting the cornucopia of data increasingly gathered from viewers. While some studio chiefs publicly chafe over the demands from striking actors and writers as being unrealistic, they know that their heavy investments in “adtech” will drive greater profitability. Streaming video data not only generates higher advertising and commerce revenues, but also serves as a valuable commodity for the precise online tracking and targeting of consumers.Streaming video is now a key part in what the Federal Trade Commission (FTC) calls the “commercial surveillance” marketplace. Data about our viewing behaviors, including any interactions with the content, is being gathered by connected and “smart” TVs, streaming devices such as Roku, in-house studio and network data mining operations, and by numerous targeting and measurement entities that now serve the industry. For example, Comcast’s NBCUniversal “One Platform” uses what it calls “NBCU ID”—a “first-party identifier [that] provides a persistent indicator of who a consumer is to us over time and across audiences.” Last year it rolled out “200 million unique person-level NBCU IDs mapped to 80 million households.” Disney’s Select advertising system uses a “proprietary Audience Graph” incorporating “100,000 attributes” to help “1800 turnkey” targeting segments. There are 235 million device IDs available to reach, says Disney, 110 million households. It also operates a “Disney Real-time Ad Exchange (DRAX), a data clean room and what it calls “Yoda”—a “yield optimized delivery allocation” empowering its ad server.Warner Bros. Discovery recently launched “WBD Stream,” providing marketers with “seamless access… to popular and premium content.” It also announced partnerships with several data and research companies designed to help “marketers to push consumers further down the path to purchase.” One such alliance involves “605,” which helps WBD track how effective its ads are in delivering actual sales from local retailers, including the use of set-top box data from Comcast as well as geolocation tracking information. Amazon has long supported its video streaming advertising sales, including with its “Freevee” network, through its portfolio of cutting-edge data tools. Among the ad categories targeted by Amazon’s streaming service are financial services, candy and beauty products. One advantage it touts is that streaming marketers can get help from “Amazon’s Ads data science team,” including an analysis of “signals in [the] Amazon Marketing Cloud.”Other major players in video streaming have also supercharged their data technologies, including Roku, Paramount, and Samsung, in order to target what are called “advanced audiences.” That’s the capability to have so much information available that a programmer can pinpoint a target for personalized marketing across a vast universe of media content. While subscription is a critical part of video revenues, programmers want to draw from multiple revenue streams, especially advertising. To help advance the ability of the TV business to have access to more thorough datasets, leading TV, advertising and measurement companies have formed the “U.S. Joint Industry Committee” (JIC). Warner Bros. Discovery, Fox, NBCU, TelevisaUnivision, Paramount, and AMC are among the programmers involved with JIC. They are joined by a powerhouse composed of the largest ad agencies (data holders as well), including Omnicom, WPP and Publicis. One outcome of this alliance will be a set of standards to measure the impact of video and other ads on consumers, including through the use of “Big Data” and cross-platform measurement.Of course, today’s video and filmed entertainment business includes more than ad-supported services. There’s subscription revenue for streaming–said to pass $50 billion for the U.S. this year– as well as theatrical release. But it’s very evident that the U.S. (as well as the global) entertainment business is in a major transition, where the requirement to identify, track and target an individual (or groups of people) online and as much offline as possible is essential. For example, Netflix is said to be exploring ways it can advance its own solution to personalized ad targeting, drawing its brief deal with Microsoft Advertising to a close. Leading retailers, including Walmart (NBCU) and Kroger (Disney), are also part of today’s streaming video advertising landscape. Making the connections to what we view on the screen and then buy at a store is a key selling point for today’s commercial surveillance-oriented streaming video apparatus. A growing part of the revenue from streaming will be commissions from the sale of a product after someone sees an ad and buys that product, including on the screen during a program. For example, as part of its plans to expand retail sales within its programming, NBCU’s “Checkout” service “identifies objects in video and makes them interactive and shoppable.”Another key issue for the Hollywood unions is the role of AI. With that technology already a core part of the advertising industry’s arsenal, its use will likely be integrated into video programming—something that should be addressed by the SAG-AFTRA and WGA negotiations.The unions deserve to capture a piece of the data-driven “pie” that will further drive industry profits. But there’s more at stake than a fair contract and protections for workers. Rather than unleashing the creativity of content providers who are part of a environment promoting diversity, equity and the public interest, the new system will be highly commercialized, data driven, and controlled by a handful of dominant entities. Consider the growing popularity of what are called “FAST” channels—which stands for “free ad supported streaming television.” Dozens of these channels, owned by Comcast/NBCU, Paramount, Fox, and Amazon, are now available, and filled with relatively low-cost content that can reap the profits from data and ads.The same powerful forces that helped undermine broadcasting, cable TV, and the democratic potential of what once was called the “information superhighway”—the Internet—are now at work shaping the emerging online video landscape. Advertising and marketing, which are already the influence behind the structure and affordances of digital media, are fashioning video streaming to be another—and critically important—component fostering surveillance marketing.The FTC’s forthcoming proposed rulemaking on commercial surveillance must address the role of streaming video. And the FCC should open up its own proceeding on streaming, one designed to bring structural changes to the industry in terms of ownership of content and distribution. There’s also a role for antitrust regulators to examine the data partnerships emerging from the growing collaboration by networks and studios to pool data resources. The fight for a fairer deal for writers and actors deserves the backing of regulators and the public. But a successful outcome for the strike should be just “Act One” of a comprehensive digital media reform effort. While the transformation of the U.S. TV system is significantly underway, it’s not too late to try to program “democracy” into its foundation. Jeff Chester is the executive director of the Center for Digital Democracy, a DC-based NGO that works to ensure that digital technologies serve and strengthen democratic values and institutions. Its work on streaming video is supported, in part, by the Rose Foundation for Communities and the Environment.This op-ed was initially published by the Tech Policy Press. -

CFPB Data Broker Filing - - U.S. Public Interest Research Group (PIRG) and Center for Digital Democracy (CDD)

In response to the Request for Information Regarding Data Brokers and Other Business Practices Involving the Collection and Sale of Consumer Information Docket No. CFPB-2023-0020

-

Press Release

Transatlantic Consumer Dialogue (TACD) Calling on White House and Administration to Take Immediate Action on Generative AI

Transatlantic Consumer Dialogue (TACD), a coalition of the leading consumer organizations in North America and Europe, asking policymakers on both side of the Atlantic for action

The Honorable Joseph R. BidenPresident of the United StatesThe White House1600 Pennsylvania Avenue NWWashington, DC 20500 June 20, 2023 Dear President Biden,We are writing on behalf of the Transatlantic Consumer Dialogue (TACD), a coalition of the leading consumer organizations in North America and Europe, to ask you and your administration to take immediate action regarding the rapid development of Generative Artificial Intelligence in a growing number of applications, such as text generators like ChatGPT, and the risks these entail for consumers. We are calling on policymakers and regulators on both sides of the Atlantic to use existing laws and regulations to address the problematic uses of Generative Artificial Intelligence; adopt a cautious approach to deploying Generative Artificial Intelligence in the public sector; and adopt new legislative measures to directly address Generative Artificial Intelligence harms. As companies are rapidly developing and deploying this technology and outpacing legislative efforts, we cannot leave consumers unprotected in the meantime. Generative Artificial Intelligence systems are now already widely used by consumers in the U.S. and beyond. For example, chatbots are increasingly incorporated into products and services by businesses. Although these systems are presented as helpful, saving time, costs, and labor, we are worried about serious downsides and harms they may bring about.Generative Artificial Intelligence systems are incentivized to suck up as much data as possible to train the AI models, leading to inclusion of personal data that may be irremovable once the sets have been established and the tools trained. Where training models include data that is biased or discriminatory, those biases become baked into the Generative Artificial Intelligence’s outputs, creating increasingly more biased and discriminatory content that is then disseminated. The large companies making advances in this space are already establishing monopolistic market concentration. Running Generative Artificial Intelligence tools requires enormous amounts of water and electricity, leading to heightened carbon emissions. The speed and volume of information creation with these technologies speeds the generation and spread of increasing misinformation and disinformation. Three of our members (Public Citizen, The Electronic Privacy Information Center, and The Norwegian Consumer Council) have already published reports setting forth the specific harms of Generative Artificial Intelligence and proposing steps to counter these harms – we would be happy to discuss these with you. In addition, TACD has adopted policy principles which we believe are key to safely deploying Generative Artificial Intelligence. Our goal is to provide policymakers, lawmakers, enforcement agencies, and other relevant entities with a robust starting point to ensure that Generative Artificial Intelligence does not come at the expense of consumer, civil, and human rights. If left unchecked, these harms will become permanently entrenched in the use and development of Generative Artificial Intelligence. We are calling for actions that insist upon transparency, accountability, and safety in these Generative Artificial Intelligence systems, including ensuring that discrimination, manipulation, and other serious harms are eliminated. Where uses of GAI are clearly harmful or likely to be clearly harmful, they must be barred completely. In order to combat the harms of Generative Artificial Intelligence, your administration must ensure that existing laws are enforced wherever they apply. New regulations must be passed that specifically address the serious risks and gaps in protection identified in the reports mentioned above. Companies and other entities developing Generative Artificial Intelligence must adhere to transparent and reviewable obligations. Finally, once binding standards are in place, the Trade and Technology Council must not undermine those binding standards.We welcome the administration’s efforts on AI to protect Americans’ rights and safety, particularly your efforts to center civil rights, via executive action. Furthermore, we are encouraged to see the leading enforcement agencies underscore their collective commitment to leverage their existing legal authorities to protect the American people. But more must be done, and soon, especially for those already disadvantaged and the most vulnerable, including people of color and others who have been historically underserved and marginalized, as well as children and teenagers. We want to work with you to ensure that privacy and other consumer protections remain at the forefront of these discussions, even when new technology is involved.Sincerely, Finn Lützow-Holm Myrstad Director of Digital Policy, Norwegian Consumer European Co-Chair of TACD’s Digital Policy Calli SchroederSenior Counsel and Global Privacy Counsel, EPIC U.S. Co-Chair of TACD’s Digital PolicyTransatlantic Consumer Dialogue (TACD)Rue d’Arlon 80, B-1040 Brussels Tel. +32 (0)2 743 15 90 www.tacd.org @TACD_ConsumersEC register for interest representatives: identification number 534385811072-96 -

Consumer financial safeguards for online payments needed, says U.S. PIRG & CDDBig Tech Payment PlatformsSupplemental Comments of USPIRG and the Center for Digital DemocracyCFPB-2021-0017December 7, 2022United States Public Interest Research Group (USPIRG) and the Center for Digital Democracy (CDD) submit these additional comments to further inform the Bureau’s inquiry. They amplify the comments USPIRG and CDD submitted last year.[1] We believe that since we filed our original comment, the transformation of “Big Tech” operated digital payment platforms has significantly evolved, underscoring the need for the Bureau to institute much needed consumer protection safeguards. We had described how online platform based payment services seamlessly incorporate the key elements of “commerce” today—including content, promotion, marketing, sales and payment. We explained how these elements are part of the data-driven “surveillance” and personalized marketing system that operates as the central nervous system for nearly all U.S. online operations. We raised the growing role that “social media commerce” plays in contemporary payment platforms, supporting the Bureau’s examination of Big Tech platforms and consumer financial payment services. For example, U.S. retail social media commerce sales will generate $53 billion in 2022, rising to $107 billion by 2025, according to a recent report by Insider Intelligence/eMarketer. Younger Americans, so-called “Generation Z,” are helping drive this new market—an indicator of how changing consumer financial behaviors are being shaped by the business model and affordances of the Big Tech platforms, including TikTok, Meta and Google.[2]In order to meaningfully respond to the additional questions raised by the Bureau in its re-opening of the comment period, in particular regarding how the payment platforms handle “complaints, disputes and errors” and whether they are “sufficiently staffed…to address consumer protection and provide responsible customer service,” USPIRG and CDD offer some further analysis regarding the structural problems of contemporary platform payment systems below.[3]First, payment services such as operated by Google, Meta, TikTok and others have inherent conflicts of interest.They are, as the Bureau knows, primarily advertising systems, that are designed to capture the “engagement” of individuals and groups using a largely stealth array of online marketing applications (including, for example, extensive testing to identify ways to engage in subconscious “implicit” persuasion).[4] Our prior comment and those of other consumer groups have already documented the extensive use of data profiling, machine learning, cross-platform predictive analysis and “identity” capture that are just a few of current platform monetization tactics. The continually evolving set of tools available for digital platforms to target consumers has no limits—and raises critical questions when it comes to the financial security of US consumers. The build-out of Big Tech payment platforms leveraging their unique capabilities to seamlessly combine social media, entertainment, commerce with sophisticated data-driven contemporary surveillance has transformed traditional financial services concepts. Today’s social media giants are also global consumer financial banking and retail institutions. For example, J.P. Morgan has “built a real-time payments infrastructure” for TikTok’s parent company ByteDance: “that can be connected to local clearing systems. This allows users, content producers, and influencers to be paid instantaneously and directly into their bank accounts at any day or time. ByteDance has enabled this capability in the U.S. and Europe, meaning it covers approximately one-fifth of TikTok’s 1 billion active users worldwide.”[5]J.P. Morgan assisted ByteDance to also replace its “host-to host connectivity with banks, replacing it with application programming interfaces (API) connectivity that allows real-time exchange of data” between ByteDance and Morgan. This allows ByteDance to “track and trace the end-to-end status through the SWIFT network, see and monitor payments, and allow users to check for payments via their TikTok or other ByteDance apps in real time.” Morgan also has “elevated and further future-proofed ByteDance’s cash management through a centralized account structure covering all 15 businesses” through a “virtual account management and liquidity tool.”[6]Google’s Pay operations also illustrate how distinct digital payment platforms are from previous forms of financial services. Google explains to merchants that by integrating “with Google Wallet [they can] engage with users through location-based notifications, real-time updates” and offers, including encouraging consumers to “add offers from your webpage or app directly to Google wallet.” Google promotes the use of “geofenced notifications to drive engagement” with its Pay and Wallet services as well. Google’s ability to leverage its geolocation and other granular tracking and making that information available through a package of surveillance and engagement tools to merchants to drive financial transactions in real-time is beyond the ability of a consumer to effectively address. A further issue is the growing use of “personalization” technologies to make the financial services offering even more compelling. Google has already launched its “Spot” service to deliver “payment enabled experiences for users, including “fully customized experiences” in Google Pay. Although currently available only in India and Singapore, Google’s Spot platform, which allows consumers with “a few simple taps…to search, review, choose and pay” for a product is an example of how payment services online are continually advanced—and require independent review by consumer financial regulators. It also reflects another problem regarding protecting the financial well-being of US consumers. What are the impacts to financial security when there is no distance—no time to reflect—when the seamless, machine and socially-driven marketing and payment operations are at work?[7]A good example of the lack of meaningful protections for online financial consumers is Google Pay’s use of what’s known as “discovery,” a popular digital marketing concept meaning to give enhanced prominence to a product or service. Here’s how Google describes how that concept works in its Spot-enabled Pay application: “We understand that discovery is where it starts, but building deep connections is what matters the most - a connection that doesn’t just end with a payment, but extends to effective post sale engagement. The Spot Platform helps merchants own this relationship by providing a conversational framework, so that order updates, offers, and recommendations can easily be surfaced to the customer. This is powered by our Order API which is specialised to surface updates and relevant actions for users' purchases, and the Messaging API which can surface relevant messages post checkout to the user.”[8]Meta (Facebook), along with ad giant WPP, also relies on the growing use of “discovery” applications to promote sales. In a recent report, they explain that “digital loyalty is driven by seamless shopping experiences, convenience, easy discovery, consistent availability, positive community endorsement and personal connections.”[9] Since Google and other payment platforms have relationships with dozens of financial institutions, and also have an array of different requirements for vendors and developers, USPIRG and CDD are concerned that consumers are placed at a serious disadvantage when it comes to protecting their interests and also seeking redress for complaints. The chain of digital payment services relationships, including with partners that conduct their own powerful data driven marketing systems, requires Bureau review. For example, PayPal is a partner with Google Pay, while the PayPal Commerce Platform has Salesforce as one of many partners.[10]See also PIRG’s recent comments to the FTC, for an extensive discussion of retail media networks and data clean rooms:[11]“Clean rooms are data platforms that allow companies to share first party data with one another without giving the other party full access to the underlying, user-level data. This ability to set controls on who has access to granular information about consumers is the primary reason that data clean rooms are able to subvert current privacy regulations.” Another important issue for the Bureau is the ability of the Big Tech payment platforms to collect and analyze data in ways that allow it to identify unique ways to influence consumer spending behaviors. In a recent report, Chinese ecommerce platform Alibaba explained how such a system operates: “The strength of Alibaba’s platforms allows a birds-eye view of consumer preferences, which is combined with an ecosystem of tactical solutions, to enable merchants to engage directly and co-create with consumers and source suppliers to test, adapt, develop, and launch cutting-edge products…helps merchants identify new channels and strategies to tap into the Chinese market by using precise market analysis, real-time consumer insights, and product concept testing.”[12]Such financial insights are part of what digital payment and platform services provide. PayPal, for example, gathers data on consumers as part of their “shopping journey.” In one case study for travel, PayPal explained that its campaign for Expedia involved pulling “together data-driven destination insights, creative messaging and strategic placements throughout the travel shoppers’ journey.” This included a “social media integration that drove users to a campaign landing page” powered by “data to win.” This data included what is the growing use of what’s euphemistically called “first-party data” from consumers, where there has been alleged permission to use it to target an individual. Few consumers will ever review—or have the ability to influence—the PayPal engine that is designed for merchants to “shape [their] customer journey from acquisition to retention.” This includes applications that add “flexible payment options…right on product pages or through emails;” “relevant Pay Later offer to customers with dynamic messaging;’ ability to “increase average order value” through “proprietary payment methods;” or “propose rewards as a payment option to help inspire loyalty.”[13]The impact of data-driven fostered social commerce on promoting the use of consumer payments should be assessed. For example, Shopify’s “in-app shopping experience on TikTok” claims that the placement of its “shopping tabs” by vendors on posts, profiles and product catalogs unleashes “organic discovery.” This creates “a mini-storefront that links directly to their online store for check out.’’ A TikTok executive explains how the use of today’s digital payment services are distinct—“rooted in discovery, connection, and entertainment, creating unparalleled opportunities for brands to capture consumers’ attention…that drives [them] directly to the digital point of purchase.”[14] TikTok also has partnered with Stripe, helping it “become much more integrated with the world of payments and fintech.”[15]TikTok’s Stripe integrations enable “sellers to send fans directly from TikTok videos, ads, and shopping tabs on their profiles to products available in their existing Square Online (link is external)store, providing a streamlined shopping experience that retains the look and feel of their personal brand.”[16] The Square/TikTok payment alliance illustrates the role that data driven commercial surveillance marketing plays in payment operations, such as the use of the “TikTok pixel” and “advanced matching.”[17] In China, ByteDance’s payment services reflects its growing ability to leverage its mass customer data capture for social media driven marketing and financial services.[18]We urge the Bureau to examine TikTok’s data and marketing practices as it transfers U.S. user information to servers in the U.S., the so-called “Project Texas,” to identify how “sensitive” data may be part of its financial services offerings.[19]Apple’s payment services deserve further scrutiny as its reintroduces its role as a digital advertising network, leveraging its dominant position in the mobile and app markets.[20] PayPal recently announced that it will be “working with Apple to enhance offerings for PayPal and Venmo merchants and consumers.” Apple is also making its payment service available through additional vendors, including the giant Kroger grocery store chain stores in California.[21]Amazon announced in October 2022 that Venmo was now an official payment service, where users could, during checkout, “select “Select a payment method” and then “Add a Venmo account.” This will redirect them to the Venmo app, where they can complete the authentication. Users can also choose Venmo to be their default payment method for Amazon purchases on that screen.”[22] Amazon’s AWS partners with fintech provider Plaid, another example of far-reaching partnerships restructuring the consumer financial services market.[23]ConclusionUSPIRG and CDD hope that both our original comments and these additional comments help the Bureau to understand the impact of rapid changes in Big Tech’s payments network relationships and partnerships. We believe urgent CFPB action is needed to protect consumers from the threat of Big Tech’s continued efforts to breach the important wall separating banking and commerce and to ensure that all players in the financial marketplace follow all the rules. Please contact us with additional questions.Sincerely yours,Jeff Chester, Executive Director, Center for Digital DemocracyEdmund Mierzwinski, Senior Director, Federal Consumer Program, U.S. PIRG [[1] /comment/CFPB-2021-0017-0079[2] /what-s-behind-social-commerce-surge-5-charts[3] We also believe that the Bureau’s request for comments concerning potential abuse of terms of service and use of penalties merits discussion. We look forward to additional comments from others. [4] /business/en-US/blog/mediascience-study-brands-memorable-tiktok; see Google, Meta, TikTok as well: https://www.neuronsinc.com/cases[5] /content/dam/jpm/treasury-services/documents/case-study-bytedance.pdf[6] /content/dam/jpm/treasury-services/documents/case-study-bytedance.pdf[7] /about/business/checkout/(link is external); /pay/spot(link is external); /about/business/passes-and-rewards/[8] /pay/spot[9] /news/meta-publishes-new-report-on-the-importance-of-building-brand-loyalty-in-on/625603/[10] See, for example, the numerous bank partners of Google in the US alone: /wallet/answer/12168634?hl=en. Also: /payments/apis-secure/u/0/get_legal_document?ldo=0&ldt=buyertos&ldr=us; /wallet/retail; /wallet/retail/offers/resources/terms-of-service; /us/webapps/mpp/google-pay-paypal; /products/commerce-cloud/overview/?cc=dwdcmain[11] /wp-content/uploads/2022/11/PIRG-FTC-data-comment-no-petitions-Nov-2022.pdf[12] /article/how-merchants-can-use-consumer-insights-from-alibaba-to-power-product-development/482374[13] /us/brc/article/enterprise-solutions-expedia-case-study(link is external); /us/brc/article/enterprise-solutions-acquire-and-retain-customers[14] /scaling-social-commerce-shopify-introduces-new-in-app-shopping-experiences-on-tiktok#[15] /financial-services-finserv/tiktok-partners-fintech-firm-stripe-tips-payments[16] /us/en/press/square-x-tiktok[17] /help/us/en/article/7653-connect-square-online-with-tiktok(link is external); /help/article/data-sharing-tiktok-pixel-partners[18] /video/douyin-chinas-version-tiktok-charge-093000931.html; /2021/01/19/tiktok-owner-bytedance-launches-mobile-payments-in-china-.html[19] /a/202211/16/WS6374c81ea31049175432a1d8.html[20] /news/newsletters/2022-08-14/apple-aapl-set-to-expand-advertising-bringing-ads-to-maps-tv-and-books-apps-l6tdqqmg?sref=QDmhoVl8[21] /231198771/files/doc_financials/2022/q3/PYPL-Q3-22-Earnings-Release.pdf;/2022/11/08/ralphs-begins-accepting-apple-pay/[22] /2022/10/25/amazon-now-allows-customers-to-make-payments-through-venmo/[23] /blogs/apn/how-to-build-a-fintech-app-on-aws-using-the-plaid-api/pirg_cdd_cfpb_comments_7dec2022.pdfJeff Chester

-

Coalition of child advocacy, health, safety, privacy and consumer organization document how data-driven marketing undermines privacy and welfare of young peopleChildren and teenagers experience widespread commercial surveillance practices to collect data used to target them with marketing. Targeted and personalized advertising remains the dominant business model for digital media, with the marketing and advertising industry identifying children and teens as a prime target. Minors are relentlessly pursued while, simultaneously, they are spending more time online than ever before. Children’s lives are filled with surveillance, involving the collection of vast amounts of personal data of online users. This surveillance, informed by behavior science and maximized by evolving technologies, allows platforms and marketers to profile and manipulate children.The prevalence of surveillance advertising and targeted marketing aimed at minors is unfair in violation of Section 5. Specifically, data-driven marketing and targeted advertising causes substantial harm to children and teens by:violating their privacy;manipulating them into being interested in harmful products;undermining their autonomyperpetuating discrimination and bias;Additionally, the design choices tech companies use to optimize engagement and data collection in order to target marketing to minors further harm children and teens. These harms include undermining their physical and mental wellbeing and increasing the risk of problematic internet risk. These harms cannot reasonably be avoided by minors or their families, and there are no countervailing benefits to consumers or competition that outweigh these harms.Surveillance advertising is also deceptive to children, as defined by the Federal Trade Commission. The representations made about surveillance advertising by adtech companies, social media companies, apps, and games are likely to mislead minors and their parents and guardians. These misrepresentations and omissions are material. Many companies also mislead minors and their guardians by omission because they fail to disclose important information about their practices. These practices impact the choices of minors and their families every day as they use websites, apps, and services without an understanding of the complex system of data collection, retention, and sharing that is used to influence them online. We therefore urge the Commission to promulgate a rule that prohibits targeted marketing to children and teenagers.Groups filing the comment included: The Center for Digital Democracy, Fairplay, and #HalfTheStory, American Academy of Pediatrics, Becca Schmill Foundation, Berkeley Media Studies Group, Children and Screens: Institute of Digital Media and Child Development, Consumer Federation of America, Consumer Federation of California, CUNY Urban Food Policy Institute, Eating Disorders Coalition for Research, Policy & Action, Enough is Enough, LookUp.live, Lynn’s Warriors, National Eating Disorders Association, Parents Television and Media Council, ParentsTogether, Peace Educators Allied for Children Everywhere (P.E.A.C.E.), Public Citizen and UConn Rudd Center for Food Policy & Health FairPlay's executive director Josh Golin said: "Big Tech's commercial surveillance business model undermines young people's wellbeing and development. It causes kids and teens to spend excessive time online, and exposes them to harmful content and advertising targeted to their vulnerabilities. The FTC must adopt a series of safeguards to allow vulnerable youth to play, learn, and socialize online without being manipulated or harmed. Most importantly, the Commission should prohibit data-driven advertising and marketing to children and teens, and make clear that Silicon Valley profits cannot come at the expense of young people's wellbeing.”CDD's Jeff Chester underscored this saying: "Children and teens are key commercial targets of today’s data-driven surveillance complex. Their lives are tethered to a far-reaching system that is specifically designed to influence how they spend their time and money online, and uses artificial intelligence, virtual reality, geo-tracking, neuromarketing and more to do so. In addition to the loss of privacy, surveillance marketing threatens their well-being, health and safety. It’s time for the Federal Trade Commission to enact safeguards that protect young people. "[full filing attached]

-

Press Release

Press Statement regarding today’s FTC Notice of Proposed Rulemaking Regarding the Commercial Surveillance and Data Security

Press Statement regarding today’s FTC Notice(link is external) of Proposed Rulemaking Regarding the Commercial Surveillance and Data SecurityKatharina Kopp, Deputy Director, Center for Digital Democracy:Today, the Federal Trade Commission issued its long overdue advanced notice of proposed rulemaking (ANPRM) regarding a trade regulation rule on commercial surveillance and data security. The ANPRM aims to address the prevalent and increasingly unavoidable harms of commercial surveillance. Civil society groups including civil rights groups, privacy and digital rights and children’s advocates had previously called on the commission to initiate this trade regulation rule to address the decades long failings of the commission to reign in predatory corporate practices online. CDD had called on the commission repeatedly over the last two decades to address the out-of-control surveillance advertising apparatus that is the root cause of increasingly unfair, manipulative, and discriminatory practices harming children, teens, and adults and which have a particularly negative impact on equal opportunity and equity.The Center for Digital Democracy welcomes this important initial step by the commission and looks forward to working with the FTC. CDD urges the commission to move forward expeditiously with the rule making and to ensure fair participation of stakeholders, particularly those that are disproportionately harmed by commercial surveillance.press_statement_8-11fin.pdf -

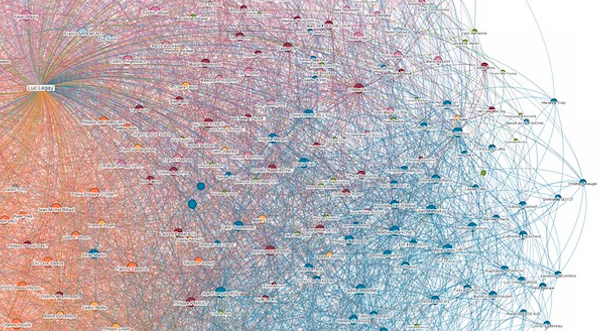

Considering Privacy Legislation in the context of contemporary digital data marketing practices Last week, the leading global advertisers, online platforms and data marketers gathered for the most important awards given by the ad industry—the “Cannes Lions.” Reviewing the winners and the “shortlist” of runners-up—competing in categories such as “Creative Data,” “Social and Influencer,” “Brand Experience & Activation,” “Creative Commerce” and “Mobile”—is essential to learn where the data-driven marketing business—and ultimately much of our digital experiences—is headed. An analysis of the entries reveals a growing role for machine learning and artificial intelligence in the creation of online marketing, along with geolocation tracking, immersive content and other “engagement” technologies. One takeaway, not surprisingly, is that the online ad industry continues to perfect techniques to secure our interest in its content so it can to gather more data from us.A U.S.-based company that also generated news during Cannes was The Trade Desk, a relatively unknown data marketing service that is playing a major role assisting advertisers and content providers to overcome any new privacy challenges posed by emerging or future legislation. The Trade Desk announced last week a further integration of its data and ad-targeting service with Amazon’s cloud AWS division, as well as a key role assisting grocer Albertsons new digital ad division. The Trade Desk has brokered a series of alliances and partnerships with Walmart, the Washington Post, Los Angeles Times, Gannett, NBC Universal, and Disney—to name only a few.There are several reasons these marketers and content publishing companies are aligning themselves with The Trade Desk. One of the most important is the company’s leadership in developing a method to collect and monetize a person’s identity for ongoing online marketing. “Unified ID 2.0” is touted to be a privacy-focused method that enables surveillance and effective ad targeting. The marketing industry refers to these identity approaches as “currencies” that enable the buying and selling of individuals for advertising. There are now dozens of identity “graph” or “identity spine” services, in addition to UDID, which reflect far-reaching partnerships among data brokers, publishers, adtech specialists, advertisers and marketing agencies. Many of these approaches are interoperable, such as the one involving Acxiom spin-off LiveRamp and The Trade Desk. A key goal, when you listen to what these identity brokers say, is that they would like to establish a universal identifier for each of us, to directly capture our attention, reap our data, and monetize our behavior. For the last several years, as a result of the enactment of the GDPR in the EU, the passage of privacy legislation in California, and the potential of federal privacy legislation, Google, Apple, Firefox and others have made changes or announced plans related to their online data practices. So-called “third party cookies,” which have long enabled commercial surveillance, are being abandoned—especially since their role has repeatedly raised concerns from data-protection regulators. Taking their place are what the surveillance marketing business believes are privacy-regulation-proof strategies. There are basically two major, but related, efforts that have been underway—here in the U.S. and globally.The first tactic is for a platform or online publisher to secure the use of our information through an affirmative consent process—called a “first-party” data relationship in the industry. The reasoning goes is that an individual wants an ongoing interaction with the site—for news, videos, groceries, drugs and other services, etc. Under this rationale, we are said to understand and approve how platforms and publishers will use our information as part of the value exchange. First-party data is becoming the most valuable asset in the global digital marketing business, enabling ongoing collection, generating insights, and helping maintain the surveillance model. It is considered to have few privacy problems. All the major platforms that raise so many troubling issues—including Google, Amazon, Meta/Facebook—operate through extensive first-party data relationships. It’s informative to see how the lead digital marketing trade group—the Interactive Advertising Bureau (IAB)—explains it: “ “first party data is your data…presents the least privacy concerns because you have full control over its collection, ownership and use.”The second tactic is a variation on the first, but also relies on various forms of identity-resolution strategies. It’s a response in part to the challenges posed by the dominance of the “walled garden” digital behemoths (Google, etc.) as well the need to overcome the impact of privacy regulation. These identity services are the replacement for cookies. Some form of first-party data is captured (and streaming video services are seen as a gold mine here to secure consent), along with additional information using machine learning to crunch data from public sources and other “signals.” Multimillion member panels of consumers who provide ongoing feedback to marketers, including information about their online behaviors, also help better determine how to effectively fashion the digital targeting elements. The Trade Desk-led UDID is one such identity framework. Another is TransUnion’s “Fabrick,” which “provides marketers with a sustainable, privacy-first foundation for all their data management, marketing and measurement needs.” Such rhetoric is typical of how the adtech/data broker/digital marketing sectors are trying to reframe how they conduct surveillance.Another related development, as part of the restructuring of the commercial surveillance economy, is the role of “data clean rooms.” Clean rooms enable data to be processed under specific rules set up by a marketer. As Advertising Agerecently explained, clean rooms enable first-party and other marketers to provide “access to their troves of data.” For Comcast’s NBCU division and Disney, this treasure chest of information comes from “set-top boxes, streaming platforms, theme parks and movie studios.” Various privacy rules are supposed to be applied; in some cases where they have consent, two or more parties will exchange their first-party data. In other cases, where they may not have such open permission, they will be able to “create really interesting ad products; whether it's a certain audience slice, or audience taxonomy, or different types of ad units….” As an NBCU executive explained about its clean room activity, “we match the data, we build custom audiences…we plan, activate and we measure. The clean room is now the safe neutral sandbox where all the parties can feel good sharing first party data without concerns of data leakage.”We currently have at least one major privacy bill in Congress that includes important protections for civil rights and restricts data targeting of children and teens, among other key provisions. It’s also important when examining these proposals to see how effective they will be in dealing with the surveillance marketing industry’s current tactics. If they don’t effectively curtail what is continuous and profound surveillance and manipulation by the major digital marketers, and also fail to rein in the power of the most dominant platforms, will such a federal privacy promise really deliver? We owe it to the public to determine whether such bills will really “clean up” the surveillance system at the core of our online lives.